By Fadi Maalouf, Chief Technology Officer, Dii Desert Energy

Carbon Capture and Storage (CCS) is a critical technology in the global energy transition towards achieving net-zero emissions. It plays a pivotal role in mitigating climate change by capturing carbon dioxide (CO₂) emissions from industrial processes and power generation, preventing them from entering the atmosphere.

Adopting CCS is central to the success of an energy transition, namely to:

- Decarbonize Hard-to-Abate Sectors: CCS is particularly vital for industries like cement, steel, and chemicals, where CO₂ emissions are inherent to the production process and cannot be eliminated through renewable energy alone[1] [2].

- Enable Negative Emissions: Technologies like Bioenergy with Carbon Capture and Storage (BECCS) and Direct Air Capture with Carbon Storage (DACCS) allow for the removal of CO₂ from the atmosphere, which is essential for offsetting emissions from sectors that are challenging to decarbonize[3].

- Complement Renewable Energy: While renewable energy sources are expanding, CCS provides a necessary bridge by addressing emissions from existing fossil fuel-based infrastructure1 2.

- Support Hydrogen Production: CCS facilitates the production of low-carbon hydrogen (blue hydrogen) by capturing emissions from natural gas reforming processes1.

Globally, the status of CSS adoption and capacity is:

- Global Capacity: As of 2024, the total capacity of operational CCS projects worldwide is approximately 50 Mtpa of CO₂1.

- Pipeline Projects: There are over 700 CCS projects in various stages of development globally, with a combined potential capacity of around 435 Mtpa by 2030. However, this is far below the required capacity to meet net-zero targets, which demand capturing and storing over 1.024 Gtpa of CO₂ by 20301.

- As present, there is around 57% shortfall in required global CSS capacity in 2030 (Figure 1).

The global CSS industry is faced with challenges, nonetheless opportunities can be leveraged to scale up:

- Policy:

- Clear policy regulatory frameworks and long-term economic signals are vital to scale up CCS technologies.

- The true long-term cost of unabated CO2 and GHG emissions and its impact on climate change must be acknowledged and factored in when designing policies and regulations, which the lack-of is evidence of unfair play. According to a recent World Economic Forum report, the cost of climate inaction could drop the world’s GDP by 22% by the year 2100[1].

- Costs:

- CCS implementation is impeded by high CAPEX and OPEX. For a CCS project capacity of 1 Mtpa CO2, the CAPEX is approximately $500M/Mtpa CO2 and the OPEX is approximately 5% of CAPEX.

- Costs vary depending on project’s economies of scale and project’s scope of work particulars for capture, transport, and storage.

- CCS projects require substantial government support and incentives, as well as private investments.

- Technology: Improvement in capture efficiency, storage site identification, storage monitoring, and CO2 utilization are making CCS increasingly feasible.

- NetZero: Regions and countries with committed NetZero targets and roadmaps will spearhead CSS adoption and thus add value in scaling up, cost reduction, and know-how buildup that can catalyse further adoption elsewhere.

The MENA region is emerging as a significant player in the global CCS landscape. With its abundant oil and gas reserves, industrial hubs, and geological formations suitable for CO₂ storage such as saline aquifer, depleted gas reservoirs and ophiolite formations, the region is well-positioned to integrate CCS into its energy transition strategies. Many counties in MENA are hosts to emissions clusters with potential nearby storage, which would support the development of CCS hubs and networks. Countries like the UAE, Saudi Arabia, and Qatar are leading the charge, leveraging CCS to decarbonize industries, produce blue hydrogen and derivatives, and enhance oil recovery (EOR) while aligning with their net-zero commitments[2].

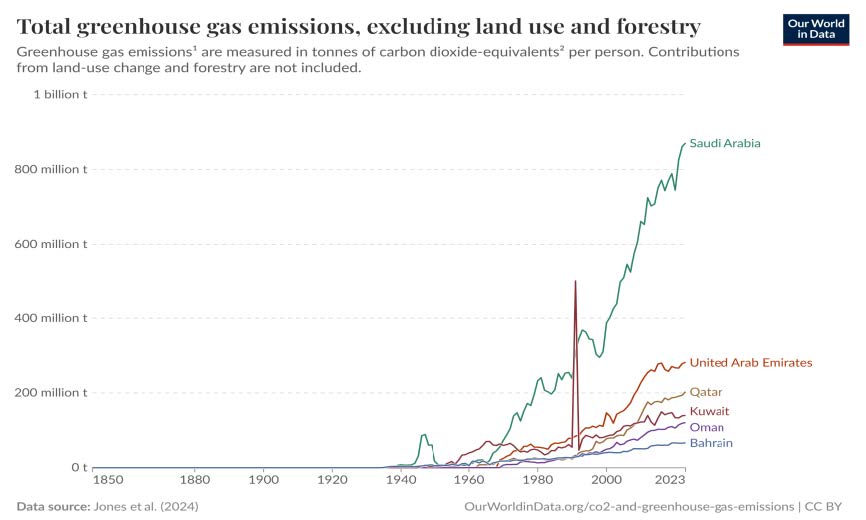

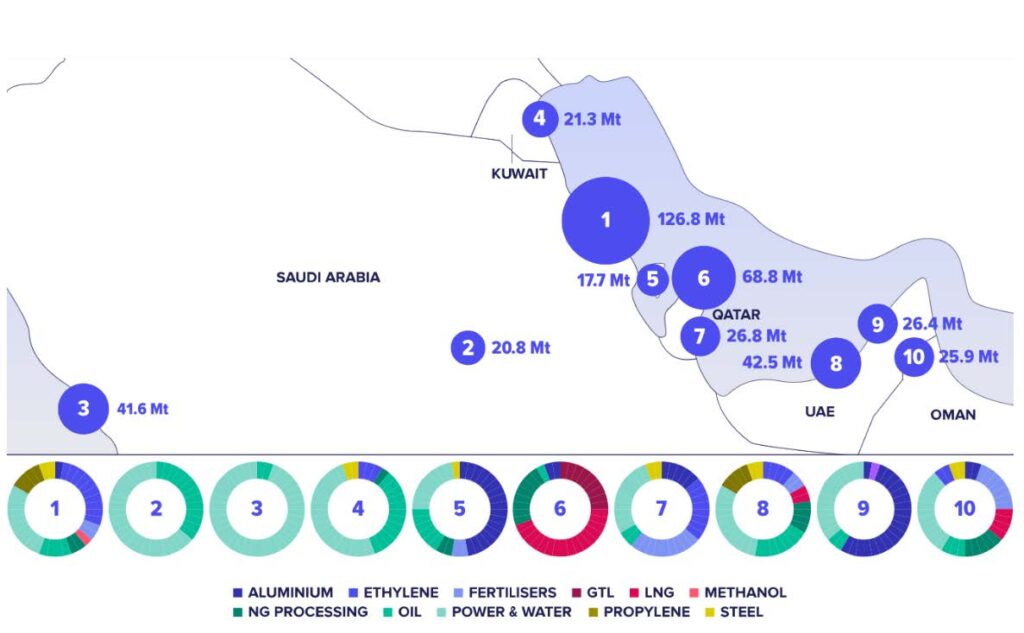

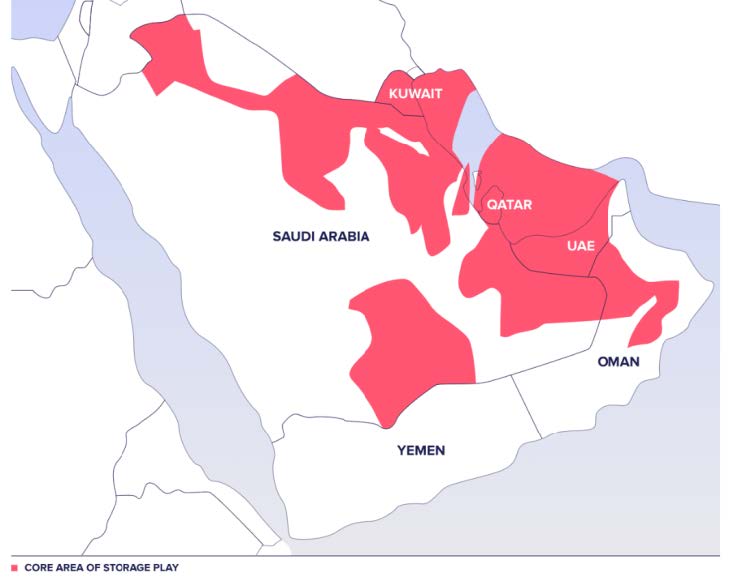

To qualify and quantify the MENA CCS overall opportunity with focus on GCC: first is the understanding of MENA GHG emissions quantity (Figure 2)[3], second is organizing CO2 capture at potential industrial clusters or hubs (Figure 3), and third is identifying suitable CO2 storage potential areas (Figure 4).

The findings of AFRY & Gaffney Cline report7 represent an impressive business case for GGC’s CCUS sector. The potential for CCUS in GCC can be summarized as follows:

- GCC’s GHG emissions stand at 1,684 Mtpa CO2eq in 20236, out of which 1,296 Mtpa CO2.

- Across GCC, there is a potential for ten CCUS hubs.

- The estimated total CO2 emissions quantity at or nearby these hubs is 418.6 Mtpa.

- These potential CCUS hubs have reasonable proximity to potential geological sinks storage sites.

- The estimated Oman ophiolite area storage capacity is 8.2 Gt CO2.

- The estimated GCC depleted gas reservoirs storage capacity is 41.5 Gt CO2.

- The estimated GCC saline aquifer storage capacity is 119.3 Gt CO2.

- The estimated total storage capacity in GCC is 169 Gt CO2.

- CCS/CCUS is not enough to decarbonize GCC. Additional potential carbon removal methods such as DACCS, e-fuels, or other offsetting schemes will be needed.

MENA governments are increasingly incorporating CCS into their climate action plans. For example, countries like the UAE (NetZero 2050), Saudi Arabia (NetZero 2060), Bahrain (NetZero 2060), Qatar (no NetZero date), and Oman (NetZero by 2050) have included CCS/CCU/CCUS in their NDCs under the Paris Agreement. Furthermore, the UAE has established policies to support CCS projects, such as ADNOC’s initiatives to invest in CCS project and [1]to expand its carbon capture capacity to 10 Mtpa by 2030[2]. Moreover, Saudi Arabia’s Aramco plans to reduce upstream carbon intensity by at least 15% by 2035 against 2018 baseline, reduce or mitigate greenhouse gas emissions by more than 50 Mtpa of CO2 equivalent by 2035, and capture, utilize or store 11 Mtpa of CO2 equivalent by 2035[3]. QatarEnergy plans to store over 11 Mtpa of CO2 by 2035[4].

The European Union’s Carbon Border Adjustment Mechanism (CBAM)[5], which is set to come into force in 2026, is a key driver for creating CCS opportunities in MENA and thus a game-changer for MENA exporters. By 2026[6], CBAM imposes carbon tariffs on imports of aluminium, iron and steel, fertilisers, cement, hydrogen and electricity into the EU. By 2030, CBAM’s product scope is expected to be extended to cover all EU ETS sectors such as crude petroleum and its derivative products, non-ferrous metals, organic chemicals, inorganic basic chemicals, industrial gases, synthetic rubber, and polymers[7].

EU CBAM is incentivizing MENA industries to adopt low-carbon technologies like CCS to remain competitive[8]. Key impacts include:

- Access to Markets:

- MENA exporters of steel, cement, hydrogen and fertilizers are investing in CCS to reduce their carbon footprint and avoid EU CBAM penalties.

- Additionally, MENA exporters are investing and/or entering into corporate renewable energy power purchase agreements (PPA) to reduce carbon footprint of their energy consumption and hence a reduction in carbon footprint of their exported commodities.

- Innovation and Investment: CBAM is driving innovation in carbon management and attracting investments in CCS infrastructure across the MENA region.

- Local Carbon Markets: Several MENA countries are considering the introduction of local mandatory carbon market (Emission Trading System, ETS). Early signs include the initial works of setting up:

- voluntary carbon credits mechanism and markets (Saudi Arabia)[9]

- national register for carbon credits (UAE)[10]

- voluntary carbon market (Egypt)[11].

As of 2024, the MENA region hosts several operational CCS/CCU projects with a combined capacity of approximately 4.5 Mtpa of CO₂. Notable projects include[12]:

| Project | Mtpa CO2 | |

| 1 | UAE ADNOC Al Reyadah CSS | 0.8 |

| 2 | Qatar QatarEnergy Ras Laffan CCS | 2.2 |

| Qatar QAFAC CCU | 0.2 | |

| 3 | KSA Uthmaniyah CCS | 0.8 |

| 4 | KSA SABIC CCU | 0.5 |

| Total | 4.5 |

In MENA, CCS pilot projects are vital to build know-how and there after scale-up. In this regard, Egypt and Italy’s Eni are developing a $25M CCS project with a capacity of 30 ktpa of CO2 at Meleiha field[1]. In Oman, 44.01’s pilot project Hajar CCS at Al Qabil has target capacity of 500 tpa of CO2[2]. In UAE, 44.10, ADNOC, FNRC and Masdar are collaborating on the development of a pilot CCS project which applies peridotite mineralisation that utilises seawater[3]. Moreover, in UAE, Fertiglobe has successfully put into operation a 3,650 tpa CCS modular system from Carbon Clean (UK) at its nitrogen fertilizer plant in Abu Dhabi[4].

The MENA region is poised for significant growth in CCS/CCU capacity, with projections indicating a potential additional capacity of more than 35.6 Mtpa of CO₂ by 2035. That is a remarkable eight-fold additional capacity to the present day installed capacity. Key planned and upcoming projects include[5]:

| Project | Mtpa CO2 | |

| 1 | UAE ADNOC Habshan | 1.5 |

| 2 | UAE ADNOC Shah | 2.7 |

| 3 | UAE ADNOC Hail & Ghasha | 1.5 |

| 4 | UAE ADNOC (balance of total 10 Mtpa planned by 2030) | 3.5 |

| 5 | KSA Aramco Jubail CCS Hub | 9 |

| 6 | KSA Aramco (balance of total 11 Mtpa planned by 2035) | 2 |

| 7 | Qatar QatarEnergy North Field East | 4.3 |

| 8 | Qatar QAFCO Blue Ammonia | 1.5 |

| Qatar QatarEnergy (balance of total 11 Mtpa planned by 2035) | 4.5 | |

| 9 | Kuwait Al Zour | 2.5 |

| 10 | Libya Eni A&E Gas Fields Mellitah CCS / Others | 1.6 |

| Egypt Shell-Energean Idku CCS | 1 | |

| Total | 35.6 |

The above potential total additional capacity may increase subject to realization of projects that are currently in feasibility and planning phases. By 2035, the capacity upside could be significant. For example, Oman is exploring three projects and avenues for carbon capture: CSS for decarbonization of Sohar Industrial Area, CSS for blue hydrogen and ammonia, and CCUS for EOR applications[1].Moreover, in UAE, Sharjah National Oil Company (SNOC) signed MoU with Sumitomo Corporation to conduct a joint feasibility study related to the potential for CCS in Sharjah and neighbouring emirates[2]. Furthermore, in Bahrain, Mitsubishi Heavy Industries (MHI) and Aluminium Bahrain (ALBA) signed MoU for feasibility study for CCS at ALBA aluminium smelter[3].

The long-term prospects of CCS in GCC are encouraging and worthwhile noting. According to the Global CCS Institute report[4], a modelling scenario “highlights an opportunity for the GCC region to act as a CO2 storage hub for regions with limited storage potential. This ability to import and store CO2 could become a significant economic activity for the region, with the potential to generate substantial revenues”.

CCS/CCU/CCUS are indispensable for achieving global climate goals, but its current global adoption and capacity must scale up significantly to meet the demands of a net-zero future. With continued mandatory compliance with the requirements of both local and international markets, investment, innovation, policy support, development of business models, MENA CCS/CCU/CCUS sector can accomplish its potential as a cornerstone of the energy transition and hence be a truly growth sector. Such growth would entail substantial revenues for the region as well as significant jobs creation.

1 IEA Carbon Capture & Storage: https://www.iea.org/energy-system/carbon-capture-utilisation-and-storage

2 IRENA Carbon Capture & Storage: https://www.irena.org/Energy-Transition/Technology/Carbon-Capture

3 IRENA Capturing Carbon: https://www.irena.org/Technical-Papers/Capturing-Carbon

4 WEF: https://reports.weforum.org/docs/WEF_The_Cost_of_Inaction_2024.pdf

5 Global CCS Institute: https://www.globalccsinstitute.com/resources/publications-reports research/businessmodelsforccshubsmena/

6 Our World in Data: https://ourworldindata.org/grapher/total-ghg-emissions-excluding-lufc?tab=chart®ion=Asia&country=BHR~ARE~QAT~SAU~OMN~KWT

7 AFRY & Gaffney Cline report: https://www.ogci.com/wp-content/uploads/2023/04/Gulf-CCUS-challenges-and-opportunities-Mar-2022_compressed.pdf

8 ADNOC: https://www.adnoc.ae/en/News-and-Media/Press-Releases/2023/ADNOC-to-Invest-in-One-of-the-Largest-Integrated-Carbon-Capture-Projects-in-MENA

9 ADNOC: https://afdshd01.adnoc.ae/adn-prd/-/media/adnoc-v2/files/efl/adnoc-sustainability-report-2023.ashx

10 Aramco: https://www.aramco.com/en/news-media/news/2022/aramco-sustainability-report-details-next-steps-towards-operational-net-zero-ambition

11 Upstream article: https://www.upstreamonline.com/energy-transition/qatarenergy-signs-deal-with-us-giant-to-develop-carbon-capture-roadmap/2-1-1304716

12 EU CBAM: https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en

13 At present (March 2025), EU is considering proposals to delay the CBAM enforcement by one year till 2027, as well as simplifying compliance and easing administrative burdens.

14 EU CBAM: https://www.europarl.europa.eu/RegData/etudes/ATAG/2023/754626/EPRS_ATA(2023)754626_EN.pdf

15 Mitsui: https://www.mitsui.com/mgssi/en/report/detail/__icsFiles/afieldfile/2023/07/21/2306f_mashino_e.pdf

16 Saudi VCM: https://vcm.sa/en/

17 UAE Legislation: https://uaelegislation.gov.ae/en/legislations/2521

18 Egypt VCM: https://fra.gov.eg/en/vcm/

19 Compiled from various online articles and reports

20 Zawya: https://www.zawya.com/en/business/energy/egypt-to-store-carbon-dioxide-in-cooperation-with-italian-eni-lg05ybpb

21 44.01 article: https://www.4401.earth/blog/44-01-and-aircapture-announce-dac-mineralization-collaboration-in-oman

22 44.01 article: https://www.4401.earth/blog/44-01-expands-into-uae-with-fujairah-pilot

23 Compiled from various online articles and reports

24 Oman Observer article: https://www.omanobserver.om/article/1168072/business/energy/trailblazer-projects-status-for-3-ccus-ventures-in-oman

25 Sumitomo Corporation: https://www.sumitomocorp.com/en/jp/news/topics/2023/group/20230725

26 MHI article: https://www.mhi.com/news/220328.html

27 Global CCS Institute: https://www.globalccsinstitute.com/wp-content/uploads/2024/09/Business-Models-for-CCS-Hubs-Challenges-and-Opportunities-with-a-Focus-on-MENA.pdf